Bristol Gate U.S. Dividend Growth Equity

Mandate commentary

Q4 2025

Highlights

① In Q4, markets saw a broadening-out, as investors moved away from the recent concentration in mega-cap tech.

② Global growth strengthened as inflation eased, and policy turned supportive.

③ Equities and quality fixed income remain positioned for growth.

Mandate overview

With the S&P US Dividend Growers, S&P 500 Dividend Aristocrats and S&P 500 Equal Weight outperforming the broad index over the last two months, continued broadening will aid our strategy. Passive index investing will not be able capture the broadening out theme relative to focused style/factor or active strategies that are diversified beyond the concentrated market capitalization weighting of the S&P 500 index.

With the S&P US Dividend Growers, S&P 500 Dividend Aristocrats and S&P 500 Equal Weight outperforming the broad index over the last two months, continued broadening will aid our strategy. Passive index investing will not be able capture the broadening out theme relative to focused style/factor or active strategies that are diversified beyond the concentrated market capitalization weighting of the S&P 500 index.

Our portfolio companies exhibit strong fundamentals, and many are trading at attractive valuations, which the market has ignored for most of the year. These are businesses with competitive advantages, healthy balance sheets and a commitment to rewarding shareholders through a rapidly growing dividend. This was underlined by the fact our portfolio companies grew their dividends by 14.3% over the last twelve months, compared to 5.6% for the S&P 500 Index. Given their financial power, we see even more reason to focus on high-dividend growth stocks.

Mandate: Outperformed the S&P 500 TR Index.

Performance contributors

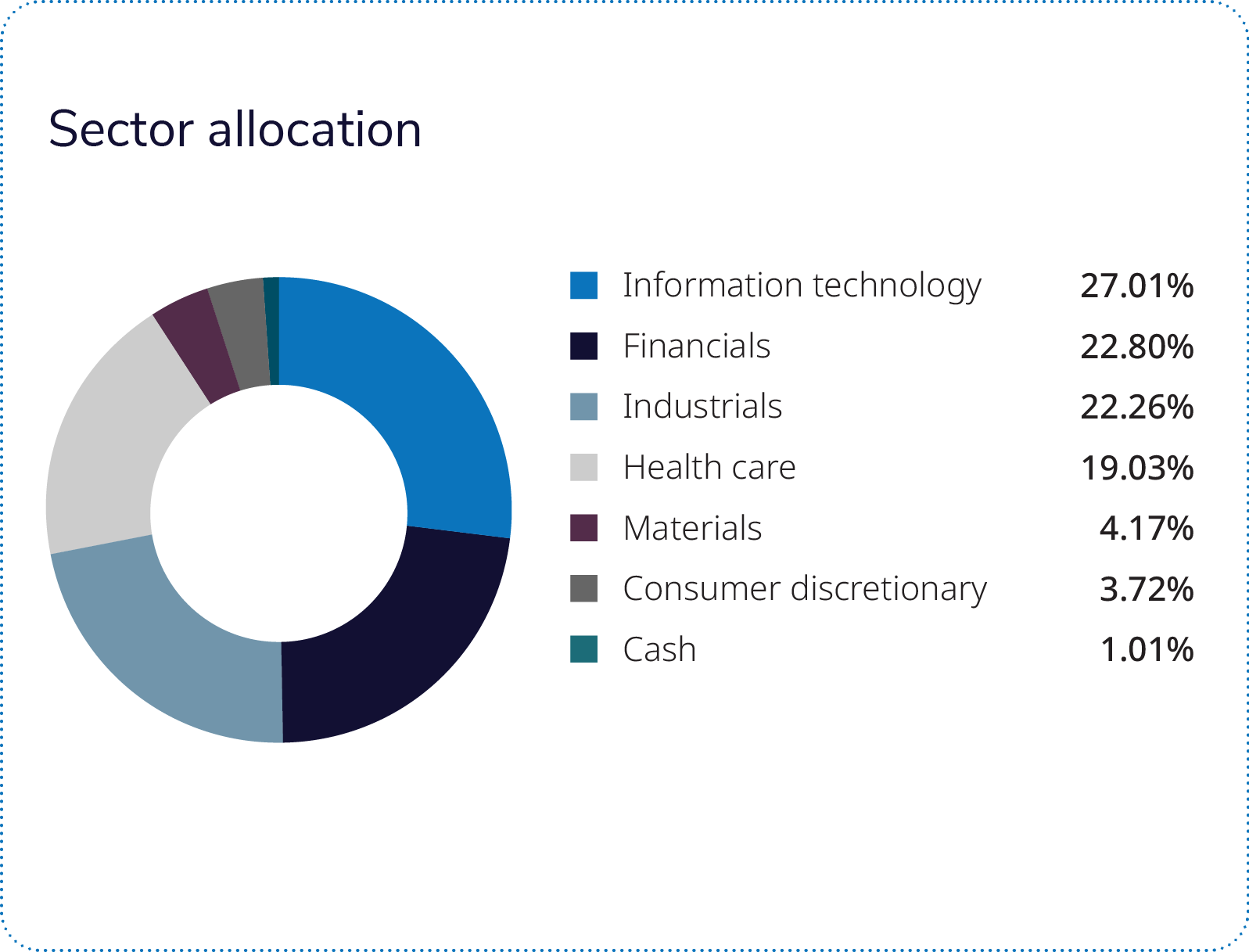

From a sector perspective, health care, information technology and financials were the leading contributors in the quarter.

On an absolute basis, leading contributors included Eli Lilly, Applied Materials and Thermo Fisher Scientific.

Performance detractors

Materials and consumer discretionary were the only negative absolute sectors in Q4.

Zoetis, Carrier Global and Cintas were the main detractors from a stock perspective.

Total gross returns:

Total return | QTD | YTD | 1YR | 3YR | 5YR | Since INC. (NOV. 14, 2016) |

BRISTOL GATE U.S. DIVIDEND GROWTH EQUITY | 4.43%

| 10.63%

| 10.63%

| 15.23%

| 10.42%

| 13.17%

|

Mandate repositioning

During the quarter we initiated a position in Interactive Brokers (IBKR) and sold Zoetis. Zoetis was sold because of deteriorating dividend growth. We held Zoetis for over six years and, until 2025, the company had an annualized dividend growth rate of 22% during our holding period.

In addition to the above noted trade, as part of our rebalancing process, we trimmed Broadcom, Applied Materials, GE Aerospace, Microsoft, Thermo Fisher Scientific and Eli Lilly. We added to Accenture, Carrier Global, Zoetis and Old Dominion Freight Line.

Market overview: global growth strengthened, inflation eased, policy supportive

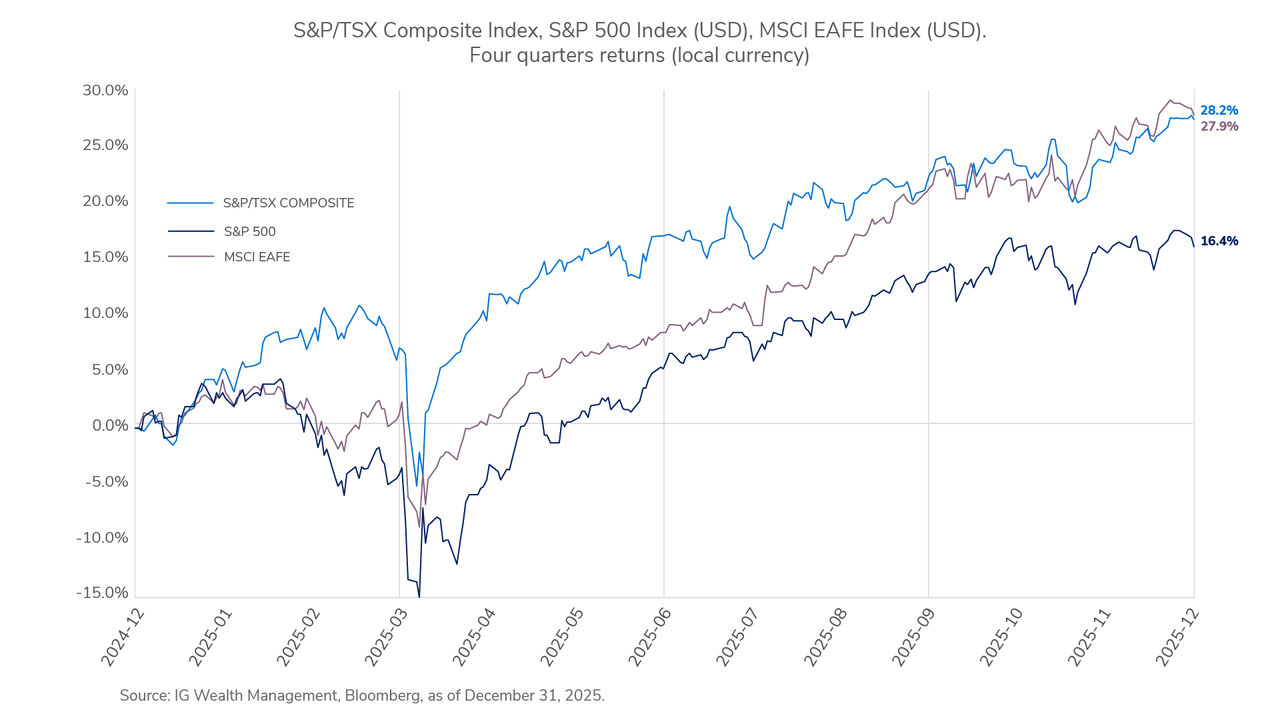

Markets ended the fourth quarter of 2025 on a strong note, capping a year defined by resilience and broad-based gains. Equities led performance, as investors looked beyond policy noise and focused on improving fundamentals. Global markets advanced, supported by steady corporate earnings, easing inflation pressures and a clear shift toward lower interest rates. Canada outperformed most developed peers, driven by strength in materials and financials, while European and Asian markets rebounded on firmer trade activity and renewed investor confidence. In the U.S., equity performance remained positive, led by technology and communication services, with improving breadth across sectors signalling a healthier market foundation.

Fixed income delivered modest but positive returns, as central banks continued to ease policy. Government yields declined on the short end while longer maturities remained stable, allowing coupon income to drive returns. Credit conditions stayed firm, underscoring the strength of corporate balance sheets entering 2026.

Market outlook: equities and quality fixed income positioned for growth

Entering 2026, global markets are positioned on a solid footing. Easing monetary policy and supportive fiscal conditions are expected to sustain growth across major economies. In the U.S., healthy earnings and productivity gains continue to anchor performance. Canada benefits from resource strength and steady financials, while Europe and Asia offer improving valuation opportunities through accelerating trade and industrial expansion. Fixed income markets provide renewed income potential as yields stabilize, and credit quality remains robust.

Overall, conditions favour a balanced, diversified approach.

To discuss your investment strategy, speak to your IG Advisor.

Azure Managed Investments™ provides discretionary investment management services distributed by IG Wealth Management Inc., Investment dealer. We will manage your Azure Managed Investments Accounts on a segregated basis in accordance with your investment policy statement and the resulting mandate selected by you. Mandates will be managed by I.G. Investment Management, Ltd. and partner organizations. You are required to make a minimum initial investment of $150,000; please read the Azure Managed Investment Account Agreement for complete details, including fees and expenses.

This commentary may contain forward-looking information, which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. It may contain certain forward-looking statements regarding the market conditions which are based upon assumptions believed to be reasonable at the time of publishing. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Past performance may not be repeated and is not indicative of future results. Actual performance may vary due to a range of factors including but not limited to current market conditions, timing of contributions and withdrawals, client-imposed restrictions, fees, expenses, tax considerations and other individual circumstances. There are no assurances that any mandate will achieve its objectives and/or avoid any losses.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

©2026 IGWM Inc.